The landscape of remote work, whether it is managing remote employees or remote work laws in general is incredibly intricate and difficult to navigate. As effective and helpful as remote work is, there are certain pitfalls to avoid both in the legal sense and in terms of managing remote performance.

To help you navigate that very landscape, we put together this guide to the laws surrounding remote work. If you’ve found yourself asking questions such as “Are there any laws about remote work?” or “How do taxes work if I’m working remotely in other states?”, then this article is for you.

If you have remote employees and you are curious about the laws and legislations about remote work, this article is definitely for you as well!

Before we get going, we do need to make a disclaimer. This isn’t legal advice and we are in no way shape or form acting as your lawyer. Now without further ado, let’s dive right into it!

Table of Contents

Keep Up With All The Latest Trends In Remote Work

Managing remote teams is more than just managing the legal side. Remote work is a landscape that is growing more and more complicated with each passing day. To keep your finger on the pulse of managing remote teams in 2024, check out the most comprehensive resource on boosting remote employee performance.

Keep up with all the latest developments in the world of remote work!

Remote Work Laws & Regulations In The United States

While the United States lacks comprehensive federal legislation specifically addressing remote work, there are still what one may consider as umbrella laws that remote work can fall under the jurisdiction of. Afterall, remote work still falls under a lot of the labor laws in the United States.

Remote work arrangements are governed by a patchwork of federal and state laws, as well as common law principles. Federal laws provide a baseline of protections for remote workers, while state laws often add additional requirements and regulations.

Key Federal Laws Governing Remote Work In The United States

While we’ve already covered many of these federal laws in our article on performance review laws, it is key that we mention them while discussing remote work laws.

Fair Labor Standards Act (FLSA): Some labor laws apply regardless of your work arrangement. The FLSA is one of them.! Establishes minimum wage, overtime pay, and recordkeeping requirements for all employees, including remote workers.

The FLSA requires employers to pay for 20-minute breaks. Also, employees must be given 30 minutes break for meals. The meal breaks mentioned here should be uninterrupted. Remote employees are entitled to the same amount of breaks as those working under conventional models.

Family and Medical Leave Act (FMLA): Entitles eligible employees to take unpaid leave for certain family and medical reasons, regardless of their work location.

Americans with Disabilities Act (ADA): Prohibits discrimination based on disability and requires employers to make reasonable accommodations for disabled employees, including remote work arrangements when feasible.

Occupational Safety and Health Act (OSHA): While one may not be faulted for assuming that OSHA doesn’t apply to those working from home, they would, in fact, be wrong. Osha sets standards for workplace safety and health, including for remote workers, addressing ergonomics, equipment use, and hazard prevention.

Specific Requirements for US Employers and Employees Working Remotely

Remote work might have entered our lives as a novelty but remote employees have all the exact same protections in the eyes of the law as any other employee. While some specifics may vary from state to state, making sure to meet the requirements below is always a good idea.

Classification of Employees: Employers must correctly classify remote workers as either employees or independent contractors. Misclassification can lead to legal and financial penalties.

Compensation and Benefits: Remote workers are entitled to the same wages, overtime pay, and benefits as in-office employees. Employers should ensure that remote workers have access to benefits such as health insurance, retirement plans, and paid time off.

Work Hours and Overtime: Remote workers are subject to the same overtime rules as in-office employees. Employers need to track work hours and ensure that overtime is compensated accordingly.

Workplace Safety and Ergonomics: Employers have a responsibility to provide a safe working environment for remote workers, even when they are working from home.

This includes providing guidance on ergonomics, preventing musculoskeletal disorders, and addressing potential hazards. Whether an employee is working from home or from any other remote location, the employer has an obligation to make sure they are safe.

Remote Work Across State Lines

When remote workers cross state lines, employers must navigate a maze of varying tax laws and regulations, ensuring compliance and avoiding potential legal and financial repercussions.

While there aren’t any specific remote work laws covering specifically, employers and employees alike have to be careful when crossing state lines. Brian Heger has an excellent piece detailing the complexities of remote work and remote work laws around working across state lines.

Tax Withholding Dilemmas

One of the primary challenges of cross-border remote work is the determination of tax withholding responsibilities. Traditionally, income tax withholding has been straightforward, with employers deducting taxes based on the employee’s primary residence.

However, when employees work remotely from different states, determining the appropriate withholding jurisdiction becomes a tad more complex. And by a tad more, we mean a lot more.

In some cases, employers may need to withhold income taxes in multiple states, depending on the employee’s work schedule and the location of their remote worksite.

One can easily imagine how this can lead to administrative burdens and potential errors, making it crucial for employers to establish clear policies and procedures to ensure accurate withholding.

State and Local Taxes

Beyond federal income tax, employees working remotely may also be liable for state and local taxes in the jurisdictions where they perform their work. This may end up requiring employers to register as an employer in multiple states, adding to the administrative workload.

Employees, too, must be aware of their state and local tax obligations when working remotely. They may need to file multiple tax returns and make estimated tax payments to avoid penalties and interest charges. It is advisable for employees to consult with a tax advisor to understand their specific tax liabilities in different jurisdictions.

Benefits, Wage and Hour Laws, and Other Emerging Remote Work Laws & Regulations

The complexities of cross-border remote work extend beyond taxation to encompass a wide range of other legal and regulatory considerations.

Employers must ensure that their remote workers receive the benefits they are entitled to, regardless of their work location and this includes coordinating with benefit providers and navigating state-specific regulations.

Emerging laws, such as those governing privacy and paid leave, further add to the complexity of cross-border remote work. Employers must stay informed about these evolving regulations and implement appropriate policies to ensure compliance and protect employee rights.

Heger, Brian. “Implications of ‘Work from Anywhere’ – When Remote Workers Cross State Lines.” ADP Spark, 23 Aug. 2022, https://www.adp.com/spark/articles/2022/06/implications-of-work-from-anywhere-when-remote-workers-cross-state-lines.aspx.

Resources for Further Information on US Remote Work Laws

If you want to take your dive into remote work laws or overall labor laws in the United States a bit deeper, the following resources are great for you to visit.

- U.S. Department of Labor: Has comprehensive information on federal labor laws, including those applicable to remote work.

- Equal Employment Opportunity Commission: Enforces anti-discrimination laws and provides guidance on remote work arrangements in the context of disability accommodation and non-discrimination.

- Occupational Safety and Health Administration: Offers resources on workplace safety and health for remote workers, including tips on preventing musculoskeletal disorders and addressing ergonomic hazards.

- Society for Human Resource Management: Provides HR professionals with up-to-date information on remote work laws, policies, and practices.

Remote Work Laws In The United Kingdom

In the UK, as of the writing of this article, there is no specific legislation exclusively addressing remote working. That being said, just like in the United States, general health and safety requirements do extend to home working environments.

Flexible working, which includes options like variable start and finish times or working from home, is recognized and employees have the right to request such arrangements. It’s important to note that flexible working rules may vary in different regions within the UK.

Significant Developments & Baby Steps

Significant developments in employment law are anticipated, including the introduction of The Flexible Working Bill in July of 2023, related to flexible work arrangements, among other employment-related topics.

While there are no specific remote work laws granting the right to full-time remote work, every employee in the UK has the legal right to request flexible working just as the employers have the discretion to accept or refuse these requests.

Many have criticized this bill as falling short of expectations. While it does mandate employers to hear these requests out and respond in a timely manner it doesn’t really change anything else.

What Are Some Reasons To Refuse A Flexible Work Request In The UK?

There are eight central grounds for an employer to refuse a flexible work request. This has been another reason for the criticism of the lack of remote work laws in the United Kingdom. Skeptics point out that these grounds make it far too easy to refuse a flexible work request.

- Burden of Additional Costs: If accommodating the flexible working request incurs significant additional costs for the employer.

- Detrimental Effect on Ability to Meet Customer Demand: If the flexible work arrangement negatively impacts the business’s ability to meet its customer demands.

- Inability to Reorganise Work Among Existing Staff: If the requested arrangement cannot be accommodated without adversely affecting the workload or work distribution among current staff.

- Inability to Recruit Additional Staff: If the employer is unable to hire additional staff to cover the work necessary due to the flexible working arrangement.

- Detrimental Impact on Quality: If the flexible working request is likely to reduce the quality of the work or service.

- Detrimental Impact on Performance: If the request could negatively affect the overall performance of the business.

- Insufficiency of Work During the Periods the Employee Proposes to Work: If there is not enough work during the times when the employee has requested to work.

- Planned Structural Changes: If there are planned changes to the business and the flexible working request does not align with these plans.

Advisory, Conciliation and Arbitration Service (ACAS). “Responding to a flexible working request – If the request is not possible.” ACAS, 2023. Web. 23 Nov. 2023. https://www.acas.org.uk/making-a-flexible-working-request/if-your-request-is-turned-down

Remote Work Laws In Germany: A Revolutionary Proposal

As of 2021, Germany has been working on a legal regulation known as the Mobile Work Act, which, if approved, would give employees the legal right to work from home whenever possible. This law is currently under review and awaiting approval yet according to Jan Ove-Becker, an expert on international labor law, plans to expedite this act are in motion.

While the passing of this act appears to be slow, from what we know about it so far, it will be a revolutionary piece of regulation in the history of remote workforce management. Here is everything we know about the upcoming Mobile Work Act:

- Legal Entitlement to Home Office Work: The Act intends to provide a legal entitlement to a minimum of 24 days per year of work at an off-site workplace. This marks the first time such a legal entitlement would be established, which is what would make this act truly revolutionary if passed.

- Differentiation between Teleworking and Remote Working: Current regulations distinguish between teleworking (permanent home office setup) and more casual remote working. The Act aims to more clearly define and potentially regulate mobile working.

- Employer’s Difficulty in Rejecting Remote Work Requests: The draft law implies that it would be challenging for employers to reject remote work requests, especially for small businesses. Employers in sectors where physical presence isn’t crucial might need to invest significantly in mobile working infrastructure.

- Co-Determination Rights for Employee Representatives: The Act proposes enforceable rights for trade unions and works councils regarding the introduction and organization of mobile work, potentially including detailed provisions on employee accessibility and integration into company operations.

- Digital Recording of Working Time: Concerns about employees working more outside the workplace led to the proposal that employers should digitally record working times.

- Health and Safety Regulations: The Act might change the current approach to occupational health and safety, which differentiates between mobile working and teleworking. The new Act could require employers to assess risks of mobile workplaces more extensively.

- Statutory Accident Insurance Extension: The Act intends to close gaps in accident insurance coverage for home office workers, extending statutory accident insurance to include accidents occurring in home offices or during commutes from home to places like daycare centers.

“Ius Laboris.” The New German Mobile Working Act: A First Look, Ius Laboris, https://iuslaboris.com/insights/the-new-german-mobile-working-act-a-first-look/.

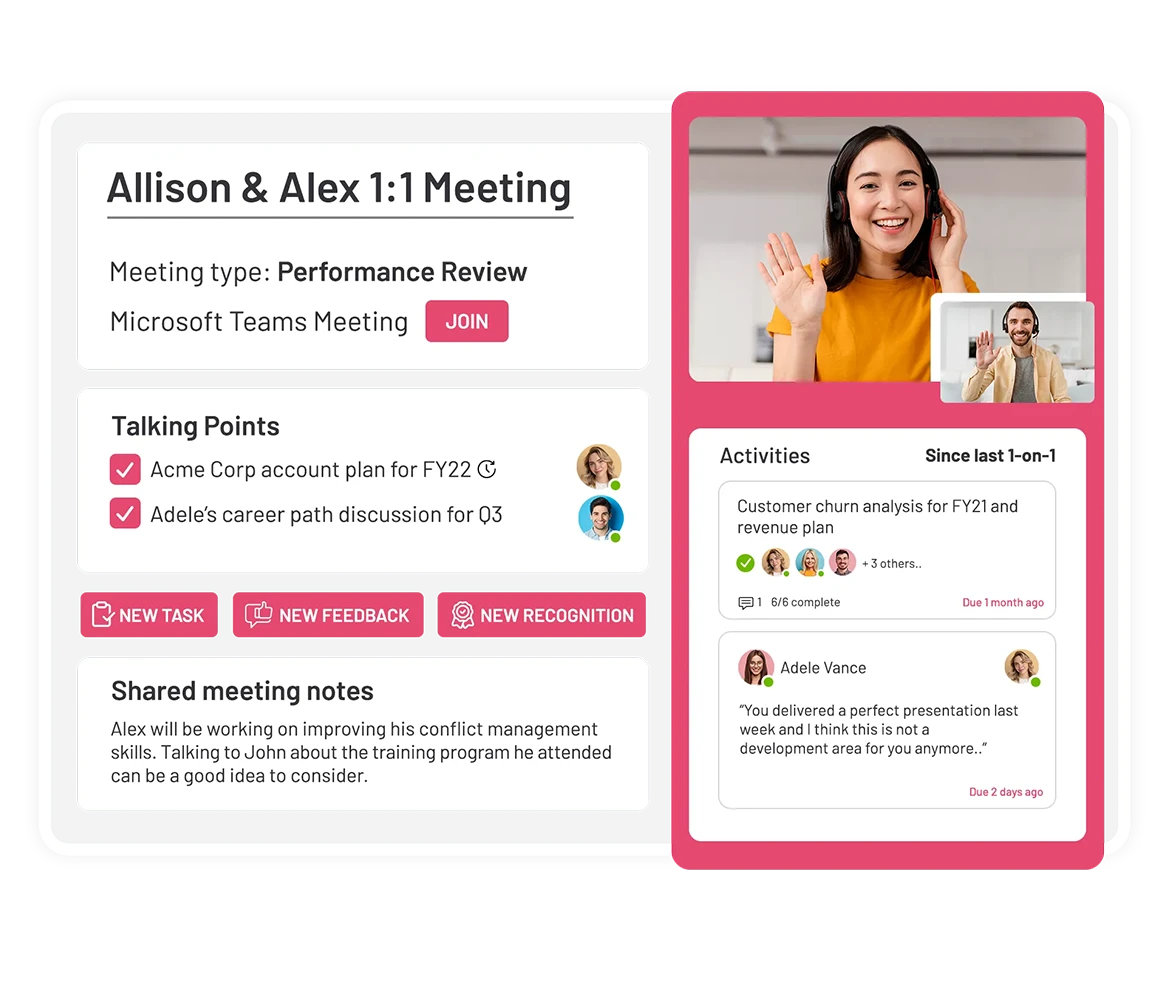

Manage Your Remote Team Effectively

When leading a remote team, the legal side isn’t the only thing you need to worry about. In fact, you shouldn’t get lost in the legal weeds and neglect giving your remote team the right infrastructure to work remotely. What does that mean? That means:

- Having a strong onboarding platform.

- Implementing remote employee engagement tools.

- Conducting regular employee satisfaction surveys.

- Having regular check-in meetings.

- Building a remote performance management system.

And a lot more! To top it all off, your team shouldn’t have to run back and forth between multiple different software to have access to all of these.

This is where Teamflect, the best performance management solution for Microsoft Teams, comes in. Teamflect lets you accomplish everything we mentioned above, alongside 360-degree feedback, and entire performance review cycles, inside Microsoft Teams.