A statutory employee operates in a unique space within the workforce, blending aspects of traditional employment and independent contracting.

In this entry, we will not only define the entire concept, but give you examples of employees that can be considered statutory, and the criteria for someone to be considered a statutory employee.

Table of Contents

What Is A Statutory Employee?

Defined by specific legal criteria, statutory employees enjoy a degree of autonomy in their work similar to freelancers, yet are recognized by tax laws in ways that align more closely with conventional employees.

This classification primarily affects tax obligations, where unlike regular employees, whose income and payroll taxes are withheld by their employer, statutory employees are responsible for paying their own income taxes but still have Social Security and Medicare taxes withheld by their employers.

This status allows them the advantage of deducting work-related expenses directly, offering a beneficial twist in how they manage and report their taxes.

What Are The Criteria For Statutory Employees?

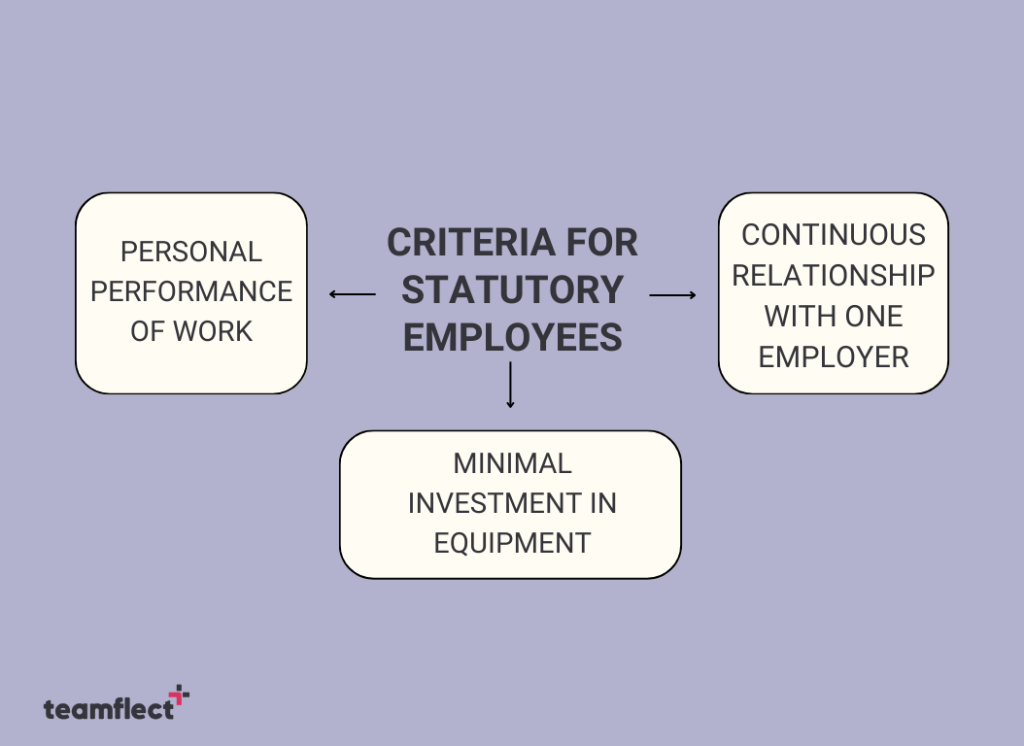

To be classified as a statutory employee, an individual must satisfy specific conditions laid out by the IRS. These criteria ensure that a worker’s status is clearly defined for tax and employment purposes.

- Personal Performance of Work: The work must be performed personally by the employee. This means they cannot delegate tasks to others.

- Minimal Investment in Equipment: The employee should not have a significant investment in the equipment or property used to perform their duties. This distinguishes them from independent contractors who often invest heavily in their business tools.

- Continuous Relationship with One Employer: The work must be for one employer on a continuing basis, which establishes a consistent and ongoing relationship between the worker and the employer.

These criteria aim to create a clear distinction between statutory employees, independent contractors, and traditional employees, focusing on the nature of work, investment in equipment, and the relationship with the employer.

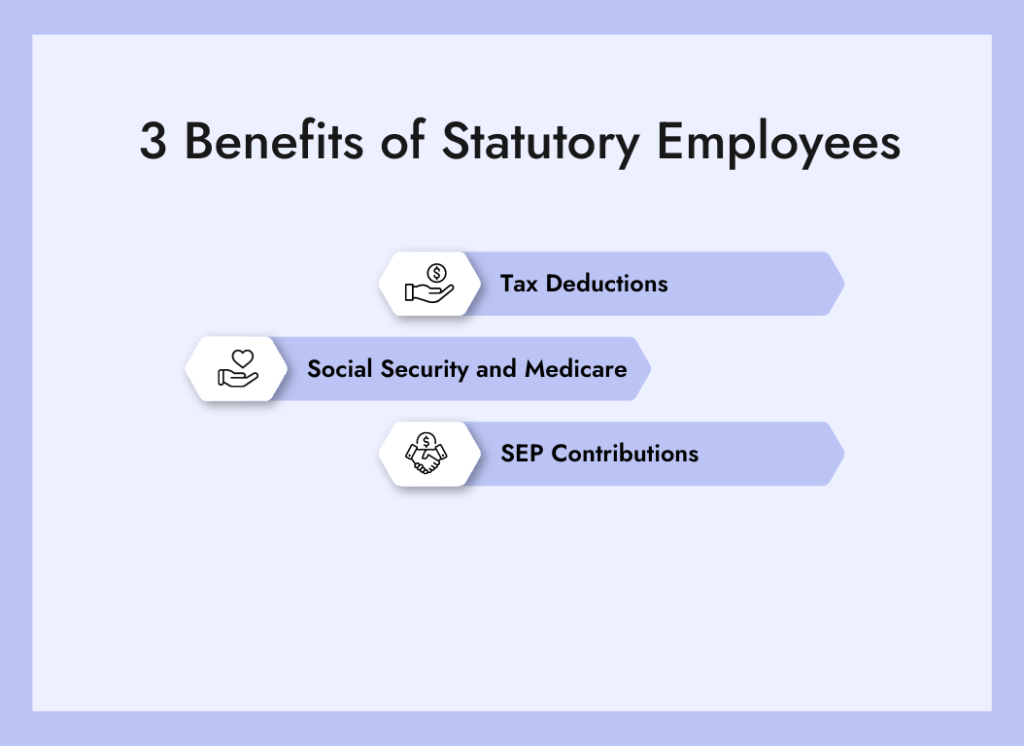

Benefits Of Being & Employing Statutory Employees

Tax Deductions: Unlike standard employees, statutory employees can deduct business expenses directly on IRS Schedule C. Tax deductions allow for potentially larger tax deductions because they are not subject to the 2% adjusted gross income threshold that applies to itemized deductions on Schedule A.

For a more accurate assessment of the tax implications of statutory employees, refer to IRS’s Article on Statutory Employees.

Social Security and Medicare: While they handle their own income taxes, Social Security and Medicare taxes are still withheld by their employers. This ensures that statutory employees contribute to and benefit from these fundamental social safety nets.

SEP Contributions: They are eligible to contribute to Simplified Employee Pension plans if they meet certain criteria, blending the retirement planning features of self-employment with employee status.

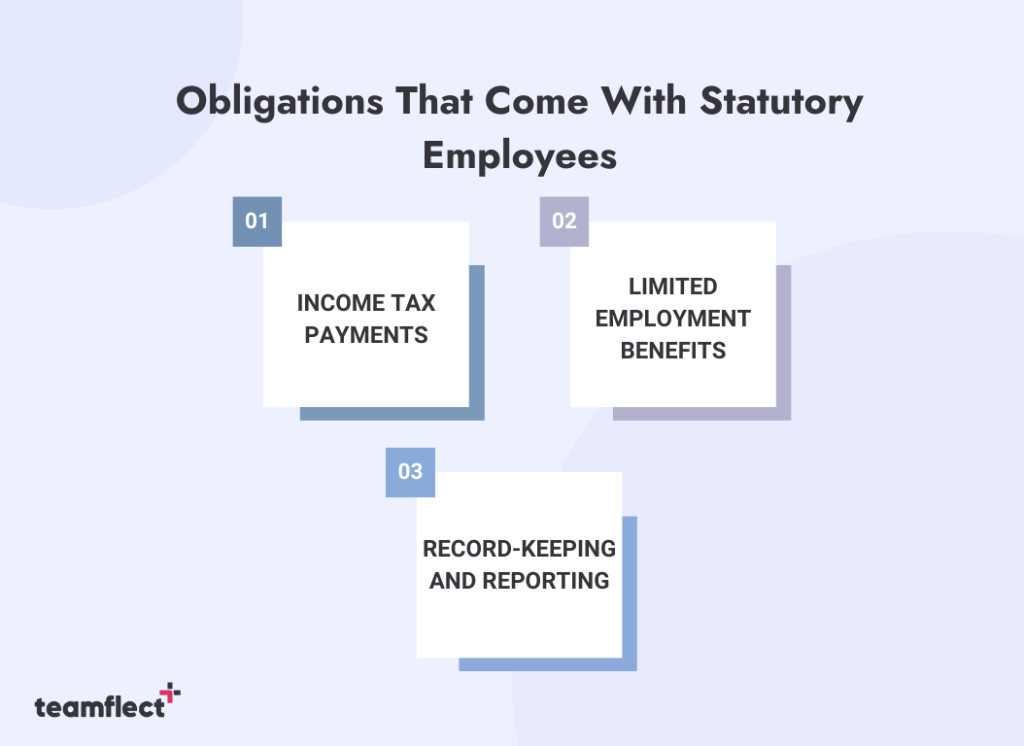

Obligations Of Statutory Employees

Income Tax Payments: Statutory employees are responsible for paying their own income taxes. This requires them to be more diligent in managing their finances, setting aside a portion of their income for tax payments, and making quarterly estimated tax payments to the IRS.

Limited Employment Benefits: Typically, statutory employees do not receive the full suite of benefits provided to traditional employees, such as health insurance, paid leave, or employer-sponsored 401(k) plans. Their benefits are more aligned with those of independent contractors.

Record-Keeping and Reporting: They must maintain meticulous records of their income and expenses, as their tax filings are more complex than those of regular employees. This includes keeping track of all eligible deductions to ensure accurate and beneficial tax reporting.

Who Counts As A Statutory Employee? Real-World Examples:

Understanding the concept of statutory employees can be challenging without seeing how it applies in real-world scenarios.

Example 1: Insurance Sales Agents

One of the most common examples of a statutory employee is insurance sales agents who work primarily for one insurance company.

Even though they might have the freedom to set their own hours and conduct business in a manner they see fit, their close association with the insurance company, including the exclusive nature of their sales for the company, qualifies them as a statutory employee.

Example 2: Home Delivery Workers

Individuals who work as home delivery workers, delivering food, beverages (excluding milk), or laundry, are often classified as statutory.

This particular classification impacts their tax filing, allowing them to claim deductions for expenses like vehicle maintenance, fuel, and other work-related costs directly against their income.

Example 3: Traveling Salespeople

Traveling salespeople who work full-time for one company, reporting directly to wholesalers, restaurants, or similar establishments, are classified as statutory employees if they are on a commission basis.

Having the statutory classification allows these salespeople to deduct their travel and other business expenses directly from their income, providing tax advantages not available to traditional employees.

Best Way To Manage Your Team

Regardless of what classification of employees form your team, you need a solid performance management platform that not only keeps track of everyone’s details but also helps you lead them.

This is where Teamflect as the best performance management software for Microsoft Teams comes in.

Not only can you assign custom attributes such as “Statutory Employee” to team members, but also:

- Conduct Performance Reviews

- Set & Track Goals

- Manage Tasks

- Conduct Pulse Surveys

And do so much more without ever having to leave Microsoft Teams!