The discussion of compensation management is an incredibly necessary one. Believe it or not, just because an organization claims all their employees are “A family!” the truth can’t be any further than that.

No matter how welcoming an atmosphere you create in the workplace and how closely you follow all the HR trends and employee engagement best practices, at the end of the day, your people are only there for one thing and one thing only: Fair compensation.

So in this particular entry, we are looking to discuss just that, and talk about the practice of compensation management in its entirety.

We will be going over the basics of compensation management, its core components, its definition, and how it relates to HR, as well as other areas surrounding the discussion of compensation management such as best practices, and alternate versions.

Table of Contents

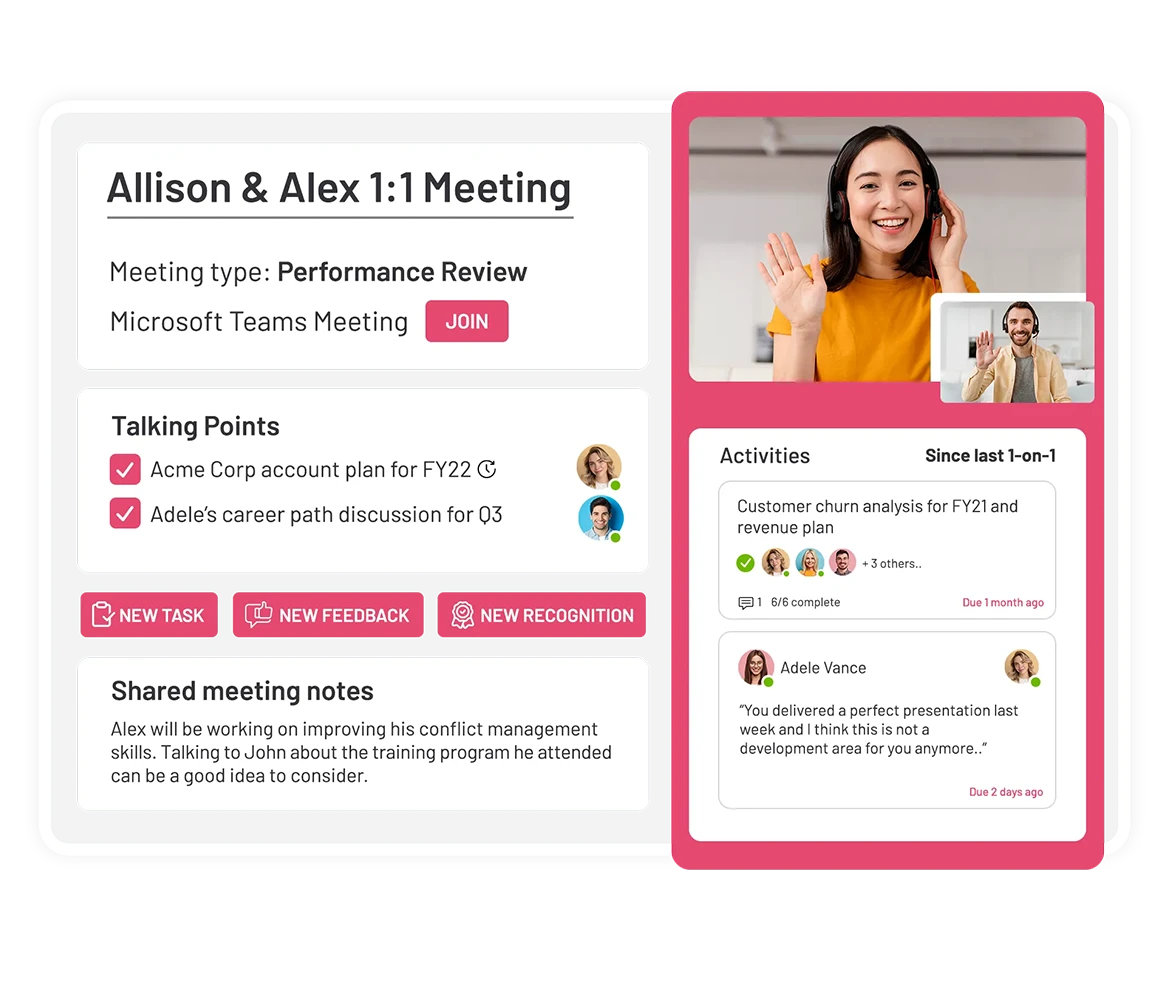

Manage Performance Remotely

Whether you’re looking to implement a fresh compensation management strategy, decide on benefits, or create an employee engagement action plan, you need a strong performance management solution. For those using Microsoft Teams on a daily basis, the best option would be Teamflect!